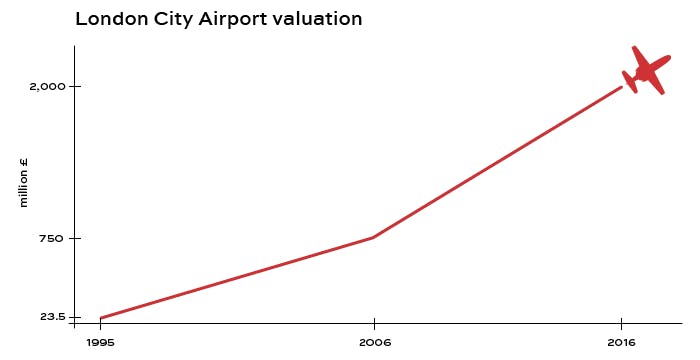

London City sees steep valuation climb to £2bn

London City Airport‘s £2bn sale announced last week, marks another point on an upward valuation climb that mirrors the airport’s steep approach of 5.5 degrees, versus the usual 3.

The airport has changed hands a few times in the last 20 years. The winner of the current deal is a consortium led by a major Canadian pension fund and discussions have been taking place since last summer, so this was expected news.

Current owners Global Infrastructure Partners bought the airport for an estimated £750m in 2006 from Irish financier Dermot Desmond, who in turn had paid just £23.5m for it in 1995, when he bought it from Mowlem. That’s quite a climb!

London City Airport is, of course, a popular London private jet airport, offering the fastest and shortest route in and out of the City and Docklands areas for business clients.

It’s also a great example of how airports can fill the gap in airline peaks with private aviation flights – and how private aviation and airline flights can work alongside each other.

Airports tend to have an airline activity peak in the morning between 08.00 and 10.00, and then again in the late afternoon between 16.00 and 18.00. Outside of these peaks, almost all airports remain fully operational and manned and must remain fully staffed in many areas – such as fire fighting and safety; Air Traffic Control; and other operational roles.

So private aviation is an excellent gap filler outside these peaks, as the demand pattern is different – offering a wider range of bespoke take off and landing times to suit the customer. The landing fees generated by business aviation provide good revenue against the airport’s costs, without too much infrastructure requirement.

Darren Grover, COO of London City Airport, was instrumental in the early success of London City’s Jet Centre. He is now on the Board of the main airport and his background in private aviation has helped to shape the airport’s notable and overall customer-focussed ethos.

It’s a success story that’s not without controversy of course. Very few are. The £2bn valuation has led to concerns from some, including British Airways, that the airport’s new owners will put up landing fees to cover the price. And plans to increase its passenger numbers to 6m by 2023 has others concerned by sound pollution.

But there’s no doubt that customers of all kinds enjoy using the airport and will continue to do so, in increasing numbers.

To book a private jet flight from London City Airport or any other global airport, contact our Flight Team for advice and pricing (24 hours) on +44 1747 642 777.

Related content

Three special ‘Leap Day’ trips by private jet

Airports get ready for Davos influx