Business Jet Buying Trends: which aircraft are in demand?

The General Aviation Manufacturers Association (GAMA) has recently released the latest aircraft shipment numbers, including how many business jet aircraft deliveries took place in 2014.

It’s interesting to see the trends taking shape at the top of the bizav supply chain. New aircraft sales, of course, ultimately create the fleet of aircraft that are available on the charter market. – so it’s something that we monitor closely.

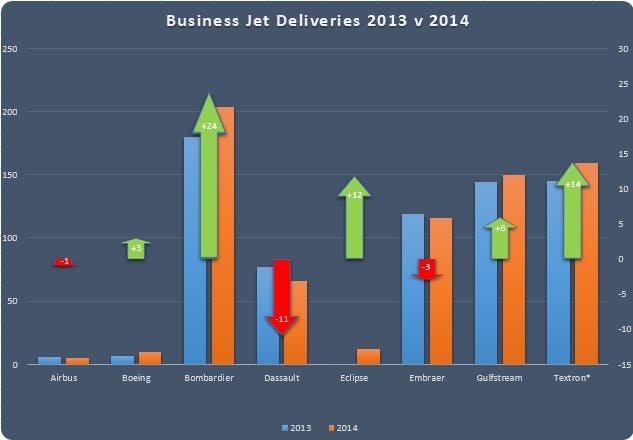

In total, business jets saw an increase of +6.8% in 2014. There were 722 new business jets delivered around the world (seeing an increase on the 678 delivered in 2013).

Here’s how the different manufacturers and individual aircraft fared:

A YEAR OF ACCELERATION FOR…

The Phenom 300. Embraer’s 6-seater light jet was the single most delivered business jet for the second year in a row, at 73 deliveries (+13 on 2013). It’s an aircraft that is also popular in the charter market due to its combination of performance, low-operating costs, and cabin comfort.

The strongest manufacturer performance overall was by Bombardier. Deliveries of its Global 5000 & 6000 reached 80 units. The Global family has a strong international appeal with both owners and charterers, which is backed up by the widespread international deliveries last year. What makes the Global so popular?

Bombardier also saw the first full year delivery result for its Learjet 70/75 which saw 33 aircraft deliveries, helping drive a Learjet revival (this reflects 83% rise on the part year in 2013).

Gulfstream continues on a strong growth path, especially in mid size. The G280 (formerly the G250) saw a +43% rise. But also in the large cabin, the G650ER (which holds the crown as the fastest and furthest business jet) saw its first deliveries.

Textron – the joint company of Cessna and Beechcraft – had a strong year with +14 deliveries, but it was all due to Cessna. New models of the Citation X+, and the CJ3+ were delivered for the first time, and the Citation M2 deliveries also saw a rise, which is the newest member of its Citation family. (Has Cessna created a rival for its own Mustang?)

A YEAR IN THE CRUISE FOR…

Airbus delivered just one less corporate jet than in 2013, playing it steady. Space seemed to be the lead appeal in the converted VIP airliner sector. Airbus saw more deliveries of their ACJ320, which features the more spacious cabin than the ACJA319 variant. In the same class, Boeing saw its biggest increase in executive 787s – four were delivered in 2014, versus just one in 2013. Plus an executive 777 was delivered. Supersize my Jet: Buying habits of the billionaires.

For Embraer, the individual success seen with the Phenom 300 was balanced out with a more testing time overall, showing drops for the Phenom 100, the Lineage 1000E, and the Legacy 650. But it saw 3 deliveries of the new Legacy 500, the first being to its native Brazil, the others to the USA.

Eclipse – 12 Eclipse 500 aircraft were delivered last year. As there were no deliveries of Eclipse aircraft in 2013, there isn’t a direct year on year trend we can measure. But at the beginning of 2014, the deliveries were looking stronger, so Eclipse will be hoping to see a stronger upturn in 2015.

A GRADUAL DESCENT FOR…

The most challenging year was seen by Dassault, who saw the steepest overall drop of -14% in deliveries, compared to 2013.

The Falcon 7X was the aircraft that saw the single biggest drop in deliveries of any type, with 27 new aircraft – the lowest since 2008. The introduction of the Falcon 8X has replaced the 7X as Dassault’s flagship aircraft, so this will have some effect. Although the 8X is a larger variant, and the two aircraft will continue to be manufactured side by side. A successful first flight for the Falcon 8X

Dassault’s Falcon 2000 is faring better and rising, with deliveries to a wide international market, including China.

Despite the fact that Boeing was steady overall, deliveries of its BBJs were notably down. This might indicate that Boeing customers are biding their time, waiting for the much anticipated and re-engined BBJ Max aircraft – which are taking orders and on the production line.

Although there are some highs and lows, it’s great to see a positive picture overall for last year. We’ll be watching the market closely to see how these aircraft trends filter into the charter market and what deliveries 2015 will bring.

(For more details about how each manufacturer performed, see Corporate Jet Investor’s recent article Business Jet Deliveries up 6.5% in 2014)

For further information about business jet pricing or aircraft types contact us or call the PrivateFly team on +44 (0) 1747 642 777

Related content

What was 2018’s bestselling private jet?

The Piaggio Avanti Evo is set for a strong summer in Europe