EBACE Day 3: Europe’s growth potential

After EBACE (the European Business Aviation Convention & Exhibition) comes to a close today, delegates will be heading back today to their desks (and cockpits) all over Europe – and beyond (the event also attracts visitors from the USA and other global markets). I am already back at my desk, after a busy couple of days in Geneva.

Hopefully, like me, most of them are heading back with a spirit of optimism about our industry and the potential for growth that Europe has.

Back in 2006 and 2007, European business aviation was growing at a rate of 10% per year. It was clear that this is an industry that has considerable growth potential, in the right economic conditions.

Of course the recession then took a hold, and this curve took a downward direction for a few years. Last year the market was still contracting (at 2.4% year-on-year). But this year, market indicators are pointing to modest growth and in my discussions at EBACE, there was a sense of excitement that ours in an industry that has so much potential in Europe.

There was much talk of collaboration, consolidation, and the need for better insight and analysis. In a nutshell, making business aviation more efficient (always a subject close to my heart).

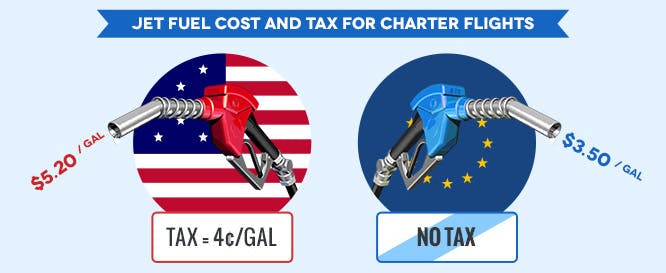

Efficiency also means more cost-effectiveness for the customer. And, as our recent analysis comparing the private jet industry in Europe and USA shows, it’s clear that there is a price gap, with Europe pricing itself above the USA.

These are other key areas I think will impact Europe’s growth over the next few years:

1) The changing private jet customer

Post-recession, the private jet customer is changing and comparing the market has become the norm, regardless of which sector you fly in: ownership, fractional or charter:

Ownership – Competition is tight in all aircraft classes. Large discounts available as the manufactures compete to fill their order books.

Fractional – Most NetJets clients are now buying fewer hours and mixing between using fractional ownership for one way flights and charter for returns and multi-legs.

Charter – Wth over 400 operators in Europe alone, private and aircraft comparison is essential.

2) Focus on fuel costs

One quarter of the cost of a private jet flight is fuel costs. Operators should be spending much more time on finding the lowest cost fuel at every destination.

3) Customers seeking more variety of aircraft – for the most efficient choice for their route

Increasingly clients are using a variety of aircraft types, not sticking to one option. London to Paris is a completely different requirement as Paris to Moscow.

4) The savvy customer will keep their options open

Today’s private jet customer would be wise not to commit to long term financial tie-ins. The market is in a state of change. Prices are still coming down. The charter market is expected to be ultra competitive for the next 3 years as supply outstrips demand. Most aircraft are not currently used to their maximum each month, so operators are still massively discounting charter.

There are many ways Europe can learn from the more mature US market which, of course, leads the way in global terms. See our new infographic and report to see some of the key differences between the two.

Related content

Three special ‘Leap Day’ trips by private jet

Love is in the air: 10 romantic private jet flights