Summer 2014: Who were Europe’s bizav winners & losers?

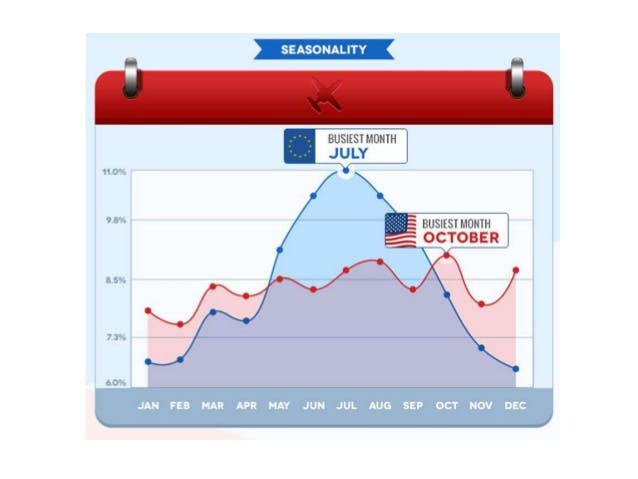

The summer months in Europe see business aviation reach its busiest period of demand, with the peak usually seen in July. This is very different to the US market which sees a much more even year-round demand. See our recent comparison: The private jet market in Europe versus USA.

Much of this is generated by the additional demand by the leisure market over the summer holiday period – travelling to European summer hotspots or to major VIP lifestyle and sports events.

With the economic downturn still making its presence felt in business aviation, this seasonal peak is a very important and much-needed boost for the industry.

So with autumn now here and the sun loungers packed away for another year, how was this peak demand period for summer 2014, and which destinations and aircraft were the winners and losers?

Industry decline overall, with growth here at PrivateFly

While at PrivateFly the news was good, it was a less positive summer for the industry overall. At PrivateFly we saw a significant increase in both enquiries and flight volumes this summer. Visits to our websites were up 125% on last year and we saw a 200% in our flight volumes during June, July and August, compared to the same period in 2013.

But in the European industry overall, each month saw a reduction on last year’s flight numbers. June just fractionally so, with 67,311 flights in total (just 0.9% lower than last year), July with 68,048 flights (-2.7% down) and August 61,831 (the biggest drop at – 3.1%). That was a total loss of over 4,000 flights compared to last summer.

Ukraine crisis made a dent in the region

Some of this, of course, is related to the crisis in the Ukraine, where airport and airspace closures have made a notable dent. In August this was seen particularly, with flights to & from the Ukraine down by -56% and Russia by -18%. The repercussions of this have also been felt in nearby Germany which saw a -9% decrease in August.

Growth in the UK and market-leader France sees a slight decline

Other regions saw a more solid summer, with the UK the strongest of the bigger markets, seeing a 5% increase in year-on-year demand and a steady year-to-date increase also. Market-leader France was fractionally lower than its 2013 summer volumes overall.

However in volume terms, France remains Europe’s biggest market by quite some distance, with 82,076 flights year-to-date in 2014 as at the end of August. This compares to 61,292 so far this year for the UK and 60,862 for Germany. These are the big three: the next biggest market Italy is much smaller, with 36,333 flights.

How did the major airports fare?

France also has two of Europe’s top 4 airports for private jets. These are 1) Paris Le Bourget 2) Geneva 3) Nice Cote D’Azur and 4) London Luton.

Europe’s busiest private jet airport Paris Le Bourget handled over 41,000 flights during June, July and August – a slight increase on 2013 volumes. Nice Cote D’Azur airport at number 3 saw almost 27,000 flights over the same period – although this was slightly down on 2013.

Number four London Luton saw impressive gains, with 23,706 flights – almost 15% up on the same three-month period last year. August in particular was very busy there, with 20% more flights than last year.

By contrast, Geneva airport had a very quiet summer – also related to the Ukraine crisis. July in particular, which saw a -13% drop , amounting to 98 fewer flights there.

In terms of city pairs, the most popular routes over the period were Nice to Moscow; Olbia to Nice; and Nice to Olbia.

Which smaller markets and airports saw growth?

Amongst the smaller European markets, notable growth was seen in private jet flights to Greece; Portugal; Sweden; Croatia; The Netherlands; Serbia; and Montenegro.

At PrivateFly we certainly saw an increase in demand to key airports in some of these regions. Private jet charter to Mykonos, Faro and Tivat were all particularly popular with our clients this year.

Long range jets seeing strong demand

When it came to aircraft trends this summer, the David & Goliath split that we’ve seen all year is continuing: The gains are being generated by aircraft at the opposite ends of the size spectrum.

Ultra Long Range jets such as the Dassault Falcon 2000 experienced a growth in demand, along with very light jets such as the Citation Mustang and other smaller jets and turboprop aircraft. See previous post for more insight: The Davids and Goliaths of private jets.

The middle of the range is still seeing the biggest challenges – including Cessna’s Citation XL/XLS/XLS+. This aircraft type still generated the biggest volumes of flights over the summer period – it has been the world’s most popular private jet for several years now – but is continues to lose share every month and this summer was no exception.

Related content

How much luggage can I take on a private jet?

Our latest exclusive Jet Card event at Dom Pérignon Maison